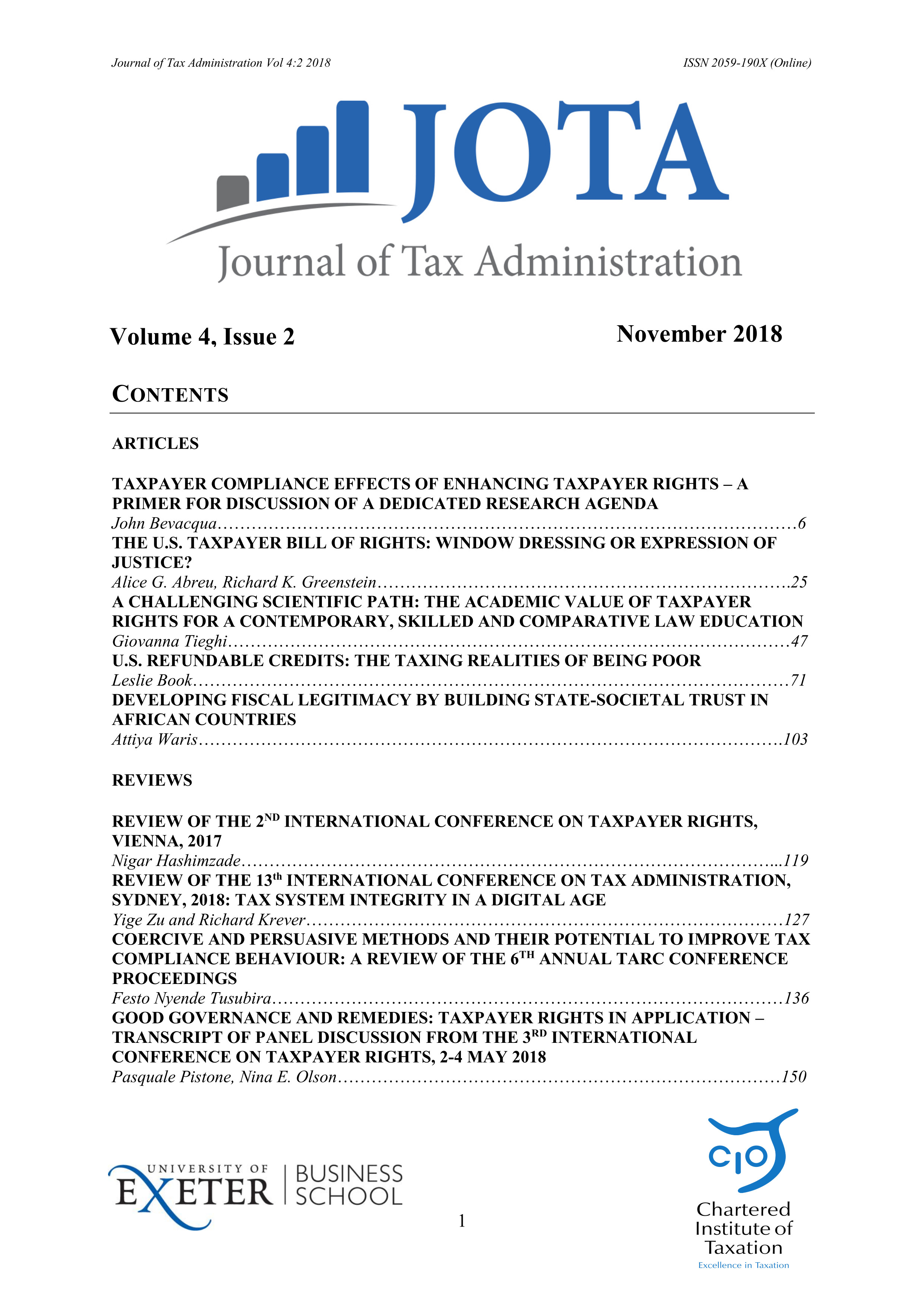

Vol. 4 No. 2 (2018): Special Issue: Taxpayer Rights

This special issue of JOTA, which was guest edited by Nina Olson, the United States National Taxpayer Advocate, explores taxpayer rights and the role that they play in strengthening rule of law, taxpayer morale, and tax compliance. It features the following articles and reviews:

John Bevacqua - Taxpayer Compliance Effects of Enhancing Taxpayer Rights - A Primer for Discussion of a Dedicated Research Agenda

Alice G. Abreu, Richard K. Greenstein - The U.S. Taxpayer Bill of Rights: Window Dressing or Expression of Justice?

Giovanna Tieghi - A Challenging Scientific Path: The Academic Value of Taxpayer Rights for a Contemporary, Skilled and Comparative Law Education

Leslie Book - U.S. Refundable Credits: The Taxing Realities of Being Poor

Attiya Waris - Developing Fiscal Legitimacy By Building State-Societal Trust in African Countries

Nigar Hashimzade - Review of the 2nd International Conference on Taxpayer Rights, Vienna, 2017

Yige Zu, Richard Krever - Review of the 13th International Conference on Tax Administration, Sydney, 2018: Tax System Integrity in a Digital Age

Festo Nyende Tusubira - Coercive and Persuasive Methods and Their Potential to Improve Tax Compliance Behaviour: A Review of the 6th Annual TARC Conference Proceedings

Pasquale Pistone, Nina E. Olson - Good Governance and Remedies: Taxpayer Rights in Application - Transcript of Panel Discussion from the 3rd International Conference on Taxpayer Rights, 2-4 May 2018